A friend sent me a fund letter a few months ago, and I ruminated over whether to post the following excerpt. Ultimately, I felt compelled to share it with our Readers given its beautifully written and reflective thoughts. It indirectly illustrates the competitive nature of this business. The author of this article (and many more just like him, or perhaps more intelligent) is your daily competition in this zero sum game. For anyone who believes that he/she has an edge, it would serve him/her well to reconsider that belief – again surfaces our daily struggle for self-awareness, and the delicate balance between arrogance and humility.

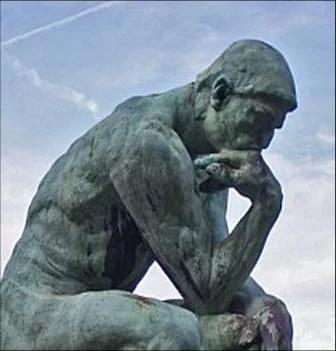

Creativity, Psychology

“I meet a lot of inquisitive and extremely intelligent people in this business and I have come to think that maybe this is something of a problem. Perhaps they are just too smart. Perhaps they just try too hard. Rightly or wrongly, the highest return on intellectual capital of any endeavour in the world today comes from the management of other people’s money. So it is entirely rational (especially if you have never met a hedge fund manager) to assume the industry attracts the brightest, smartest minds. The beautiful mind, if you will. But I am not aiming to outsmart George, Stan, Julian, Bruce or the others. I do not think it is logical to try and outsmart the smartest people. Instead, my weapons are irony and paradox. The joy of life is partly in the strange and unexpected. It is in the constant exclamation ‘Who would have thought it?’

Why did ten year treasuries yield 14% under the vice like grip of iron-man Volker but yield just 1.8% under the bookish and most definitely Weimar-like Bernanke? Why does France in 2012 flirt with the notion of electing a socialist president intent on reducing the retirement age, imposing a top rate of tax of 75% and increasing the size of the public sector? Why do we hang on the every word of elected politicians when Luxembourg’s prime minister Jean Claude Junker openly admits, ‘When it becomes serious, you have to lie’?

You cannot make stuff like this up. It is simply too absurd.

That is perhaps a long way of saying that existentialism is alive and well in the 21st century. For, if the last ten years have taught me anything, it must be that the French philosopher Albert Camus, in his search for an understanding of the principals of ethics that can shape and form our behaviour, may have surreptitiously provided us with three basic principles for macro investing. I am perhaps doing him a gross injustice, but I would summarise as follows: God is dead, life is absurd and there are no rules. In other words, you are on your own and you must take ownership of your own destiny.

For me this has always meant being detached from the sell-side community. It is not a question of respect, it is just that I prefer not to engage in their perpetual dialogue of determining where the 'flow' is. I cannot be reached by telephone. I suspect that I am one of the few CIOs who does not maintain daily correspondence with investment bankers and their specialist hedge fund sales teams. Not one buddy, not one phone call, not one instant message. I am not seeking that kind of 'edge.' [Redacted fund name] occupies an area outside the accepted belief system.

‘I have striven not to laugh at human actions, not to weep at them, not to hate them, but to understand them’ --Baruch Spinoza, Tractatus Politicus, 1676

I attempt to cultivate my own insights and to recognise the precarious uncertainty of global macro trends. I attempt to observe such things first hand through my extensive travel…and seek to understand their significance by investigating how previous societies coped under similar circumstances. But first and foremost, I am always preoccupied with the notion that I just do not have the answer. I am not blessed with the notion of certainty. Someone once said we should think of the world as a sentence with no grammar. If we do I see my job as putting in the punctuation. But above all, my job is to make money.”