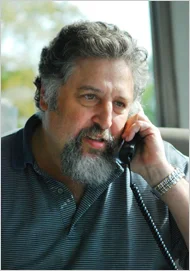

"I believed if we delivered high double-digit returns at relatively low volatility, the rest of the business would take care of itself. I have been cured of that illusion." --Andy Redleaf, Whitebox Anyone who believes that investment acumen alone is enough to build a successful investment management business should read the article below. Excerpts are derived from Andy Redleaf's April 2014 Commentary.

“Back in 1999 when I launched Whitebox, I was determined to build an investment organization full of intellectually passionate, creative money managers who by working together would perform better than as individuals—with the side benefit of an enormously fun and stimulating place to work. We would be organized around a shared investment philosophy, driven by unconventional investment ideas, and settle disagreements by reasoned argument and persuasion, not reversion to status and testosterone wars. If we had a cult it would be a cult of ideas, not of personality.

When I left Deephaven Capital Management I was in a position financially to do pretty much what I liked, including going back to what I had done for most of my career: make a nice living trading on my own account. I knew I didn’t want to do that. I liked coming up with investment ideas; figuring out what the market was thinking and how to respond, but I didn’t like doing those things alone. I wanted camaraderie. I wanted the stimulation of debate and discussion with other smart people who shared my interests but who knew things I didn’t or had skills I lacked.

So I launched Whitebox as a collaborative, intellectually dynamic organization. It was always intended not as a fund but as a fund family. And it was never my intention to manage any Whitebox fund directly…I wanted to work with people who would be better fund managers than I. My job would be to articulate our investment philosophy, foster collaboration, and propose or critique investment ideas and strategies in a way that would not discourage the flow of ideas but promote it."

"That was always the Whitebox idea. Gather together outstanding managers like Rob, Jason, Paul and our about three dozen investment professionals and talk to each other for fun and business. Twenty of those professionals—myself, the three Global Strategy Heads, and 16 “Senior Portfolio Managers”—are authorized, at need, to trade on their own authority without asking anyone’s permission. Of course they rarely do except in routine matters, because discussion and collaboration is at the core of what we do...I have no data, but I’d guess the average age of senior investment people at Whitebox is on the high side for any hedge fund that has more than a handful. People stay here.

Of those 16 Senior Portfolio Managers, by the way, none of them has an independent P&L. There are firms, even successful firms, that handle talent by giving the talent a little capital, waiting a quarter to see if they lose money or make money and then firing them or giving them more capital accordingly. It’s supposed to be a ruthlessly rational way of evaluating talent, just as the market is supposed to be ruthlessly efficient. I think it is a great way to court disaster. The Hedge Fund as Band of Quasi-Independent Gun Slingers goes against everything we set out to accomplish at Whitebox. It encourages secrecy and all the bad things that come with that. It also wastes people’s brains.

Maybe Einstein orNewton needed to work in splendid solitude, but most pretty-smart people benefit from some intellectual back and forth and the mutual support of a team. Solitude especially makes no sense for an organization focused primarily on arbitraging relative value relationships often across markets or even geographies. Metcalfe’s Law says the value of the network is the square of the nodes. Whitebox is a network of professionals. Their outbound focus may be on a particular strategy or asset class—in that sense we get the benefits of specialization. But looking in or across the network, their job is to share information so that collectively the organization has a broad view of multiple market relationships.

In any case, the fact that 16 SPMs have independent trading authority gives some sense of their stature in the firm and to what extent we have succeeded in building the collaborative, non-hierarchical, principle-based and idea-driven organization we set out to build almost 15 years ago. Our approach to the Investment Committee is another example. Ninety percent of our work is done outside of our weekly meeting in daily ongoing discussion. Even in meetings we don’t vote and no one has a veto—we discuss until we reach consensus."

"When I launched Whitebox I believed if we delivered high double-digit returns at relatively low volatility, the rest of the business would take care of itself. I have been cured of that illusion.

Over the past year or so we’ve been engaged in a monumental effort—still ongoing—to strengthen everything else about the business. Doubling the size of the Marketing Group to improve the customer experience has been part of that. I think it is beginning to show. Certainly we know many of our investors better than we did a year ago, and have more frequent contact. More recently we have expanded the responsibilities of our Communication Group to work more closely with Marketing in refining the tools we use to communicate with investors and prospective investors so that they begin to know us better as well….

Since launching Whitebox nearly 15 years ago, I believe we have built a durable organization, rooted in a set of beliefs, even an ethic, that is the real source of our ongoing success. Whitebox is not just an investment company, it is an investment culture. Helping to build that is what I’d like to be known for."